Unsurprisingly, with the Elizabeth Line finally opening its doors yesterday, the number of stories we've been seeing about its impact on property prices and rents have ramped up. Here at PIT, we've run a number of stories in recent days on this very subject.

And now property company JLL says that, as Crossrail begins its handover of stations to TfL and the line officially opens after more than three years of delay, it’s seeing a new wave of investment into property at stations along the line.

The Crossrail Bill was introduced to Parliament in February 2005, and three and a half years later, in July 2008, the Bill completed all the Parliamentary stages and received Royal Assent to become the Crossrail Act.

Works officially began on the project in 2009, with tunnelling starting in 2012. A decade on, JLL has undertaken new research to assess the impact on property values along the line.

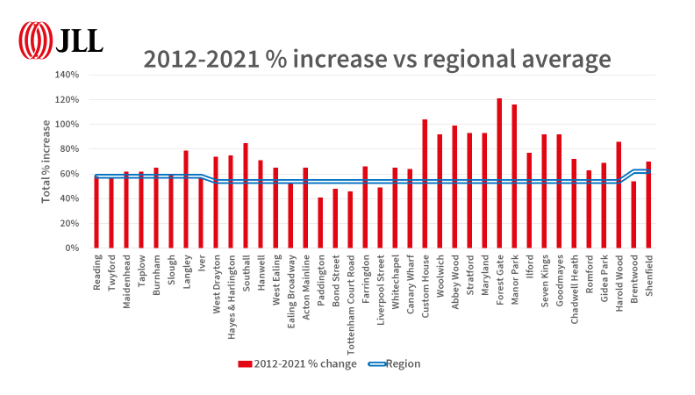

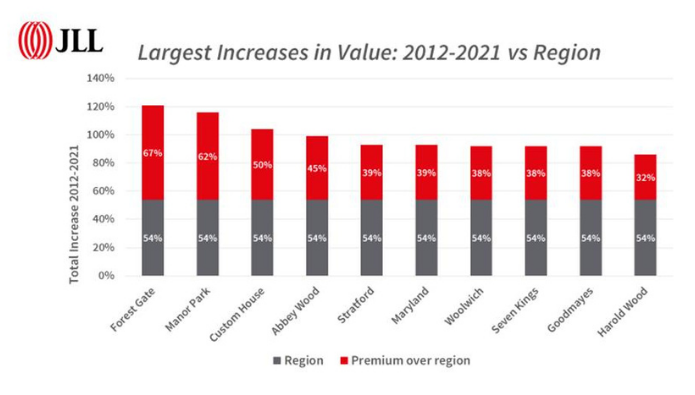

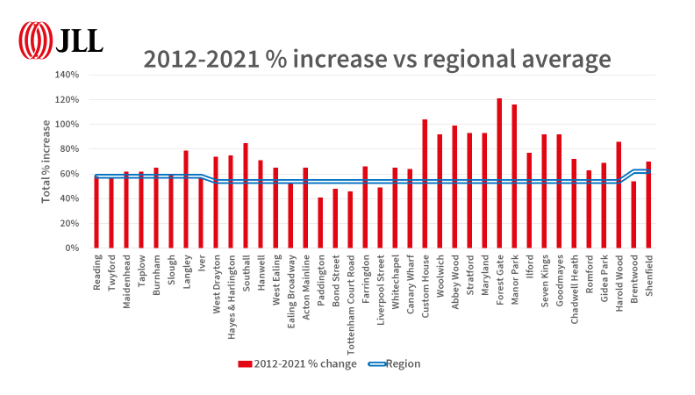

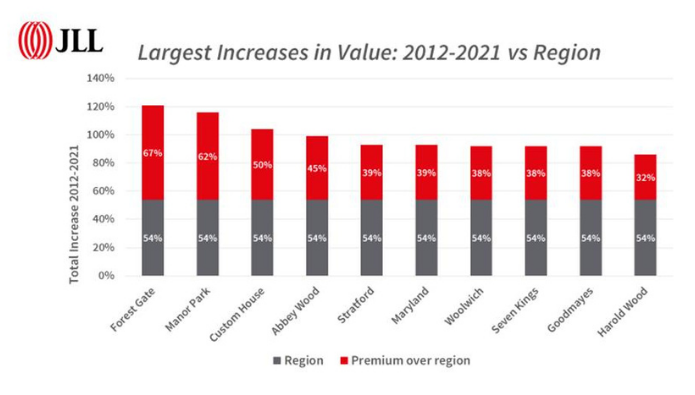

It found that, since 2012, the growth in average prices in areas surrounding 76% of Crossrail stations outperformed the regional average. Meanwhile, 18 stations have experienced sales price growth of over 70% since 2012, with the largest premiums typically found along the Eastern lines.

2005 – 2009

Between 2005 and 2009, when savvy buyers were hoping to capitalise on lower prices and higher growth, JLL said the average growth of property values across all stations was 15%. At the start of the project, between 2005 and 2009, a fifth (20%) of properties along the line saw higher house price growth than the regional average.

2012 – 2021

Between 2012 and 2021, average property values grew by 73% in the areas surrounding Crossrail stations, JLL’s research found. This is 19% higher than the growth seen across London over the same period. Some 84% of stations recorded higher house price growth than the regional average, with work starting on the project – Europe’s biggest new transport scheme - fuelling confidence in those looking to invest.

The research claims that, since 2012, investors have continued to support price growth in these areas. Right at the top, properties situated near Forest Gate have outperformed the regional average (London) over the period 2012-2021, with growth 67% higher. Homes close to Forest Gate will benefit from journey time savings of 11 minutes to Canary Wharf and 16 minutes to Paddington.

It is along the Eastern lines, in fact, where some of the largest premiums over regional averages can be found. In spite of this, past JLL research has revealed that time savings are typically the greatest from Slough and the Western section into central London. Over the past ten years, house prices in Slough – an up-and-coming area trying to shake off a bad reputation - have increased by 25% more than the regional average.

But increasing values have not merely been restricted to the western and eastern ends of the new Elizabeth Line, with Bond Street, Paddington, Farringdon and Tottenham Court Road – four of the line’s flagship areas – all witnessing their average house price more than double since works commenced in 2009.

Rising values have not been restricted to the western and eastern ends of the line though. Bond Street, Paddington, Farringdon and Tottenham Court Road have all seen their average house price more than double since works began in 2009.

Have house price premiums peaked?

The Crossrail effect on house prices has long been talked about, but will this momentum continue now that the line is open – albeit in three separate phases for the moment, with all parts joining up from May next year.

After over a decade of house price surges, JLL asks if we’ve reached a peak already, or if the best is still to come?

The firm argues that, when large regeneration or infrastructure projects are proposed, certain buyers pounce, but others want to see the improvements in place before they commit.

It says the speculators typically buy in early, acquiring homes in the anticipation that investment will lead to additional growth in house prices. They are likely to have capitalised on lower property values between 2005 and 2009 when the Crossrail bill was accepted and, subsequently, when works started.

Certain occupiers are more likely to wait and be willing to pay a premium, once improvements are in place, or in the case of Crossrail, stations open and trains begin to run. JLL believes landlords will be the first to benefit, as improved travel times and increased capacity makes the areas more attractive to prospective tenants.

“The promise of greater capacity and faster commutes have meant housing markets surrounding Crossrail stations have outperformed since the scheme was announced. But with trains starting to run across the network we could see further growth, now appealing to a new group of investors, homeowners, and tenants, waiting for the project to complete before moving in,” Meg Eglinton, senior research analyst at JLL, said.

“As Crossrail nears completion, residential areas at stations along the line have re-emerged on people’s radars, shorter commute times meaning areas previously less well connected can now compete with higher value commuter hotspots. Even with people now working more flexibly we expect a comfortable, fast, and reliable commute when they do need to travel, which will ensure that property values continue to benefit from the Crossrail ‘effect’ for years to come.”

/ElizabethLine2-400x310.jpg)

/CrossrailTrain-400x310.png)

.png)

Join the conversation

Be the first to comment (please use the comment box below)

Please login to comment